Analysts say that as high prices and economic uncertainties are prolonged, the trend of choosing used products as stable consumption alternatives instead of new products is spreading.

“For many consumers, especially Gen Z, shopping for used goods is becoming the first option,” Business Insider (BI) reported. “The rapid growth of the used fashion and luxury market will continue this year.”

According to the “2025 Re-Commerce Report” released by U.S. online used trading platform OfferUp in cooperation with global data, 54% of shoppers in Generation Z said they prefer used products in a survey of 1,500 U.S. adults. This is 10%P higher than millennials (44%).

In addition, 63 percent of Generation Z in the U.S. said they had purchased second-hand clothes and accessories, according to a survey conducted by Harry Spall in 2024. This is far higher than the average of adults (47 percent) in the U.S.

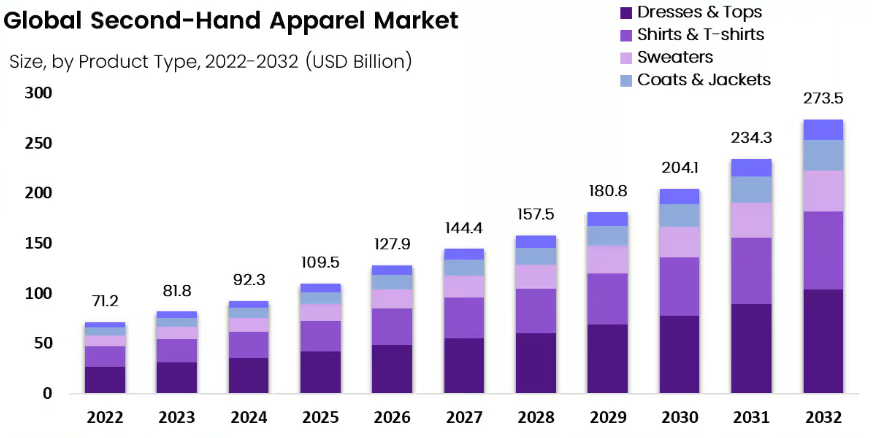

The market is also rapidly expanding. According to a report released in October last year by Boston Consulting Group (BCG) and Bestier Collective, the global used fashion and luxury goods market was estimated to be between 210 billion and 220 billion dollars last year. The market is expected to grow steadily and reach $320 billion to $360 billion by 2030. The average annual growth rate is 10%, about three times faster than the new product market.

The report also presented the results of a survey of 7,800 consumers. About 28 percent of the items in their closets were purchased secondhand. The figure is a steady increase from 21 percent in 2020 and 25 percent in 2022. By item, handbags (40 percent) and clothing (30 percent) accounted for a high proportion of used items.

Price competitiveness was cited as the biggest reason for choosing used products. About 80% of the respondents pointed to price as a motive for purchasing, and the availability of discontinued models or rare products was also mentioned as an advantage. More than half said they prefer to buy a premium brand secondhand rather than buying a new low-cost product.

This trend is also confirmed by the global fashion industry outlook. According to a report in November last year by the fashion magazine BoF and McKinsey, the used fashion and luxury markets are expected to grow two to three times faster than the new product market by 2027. The main driver of this growth was the expansion of the online resale market.

In fact, online marketplaces accounted for 88% of used transaction spending in 2024. In an eBay survey, about 82% of respondents said they plan to spend more on used goods during the holiday season in December last year than in the previous year.

“U.S. used shopping became especially popular last year,” BI said. “U.S. President Donald Trump’s tariff policy also contributed to revitalizing the used market in the U.S. As uncertainties surrounding imports grew, consumers turned to more stable options such as purchasing used goods. In addition, it added that consumer sentiment that values cost-effectiveness and the spread of second-hand trading platforms are accelerating market growth.

SALLY LEE

US ASIA JOURNAL