According to CNN and CNBC on Wednesday, Kiki Lough, a freelance consultant, is posting videos on TikTok and Instagram where she cooks herself to see how she can replace food she buys outside with ingredients at home. She also produced a video guide that introduces recipes for cookbooks that were published during times of the Great Depression, recession, and war. Her experiences during the global financial crisis are helping her a lot.

Ruf said he is not a professional chef, adding that he learned how to cook through a food stamp program for low-income people. Nevertheless, Ruf’s followers have increased by 350,000 over the past month and his posts have reached 21 million views.

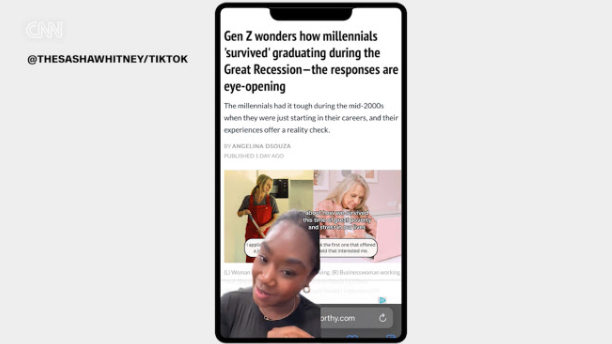

As such, posts on social media platforms such as TikTok, Instagram, and X are spreading like a trend on how to overcome the recession. This is because concerns about a recession spread in the U.S. due to U.S. President Donald Trump’s tariff policy.

Google predicted that the number of searches related to the “Global Financial Crisis” this month will hit the highest level since 2010. The search volume for “Great Recession” is also expected to reach the highest level since the COVID-19 pandemic.

Sasha Whitney, who graduated from college during the global financial crisis, told CNN, “On TikTok, I found Gen Z sharing feelings about the recession: ‘It’s unfair, frustrating, it’s grim, it’s hopeless for the future. I’ve since given them some tips on how to prepare for a recession.”

He recently posted on TikTok how to choose a job and write a resume, how to live with your income, how to delete postpaid payment platforms like Klarna Afterpay, and how to save your emergency money.

In addition, advice and experiences such as “It was my daily routine to travel to Florida cheaply, not abroad,” “I used to collect receipts to get a refund if I discounted expensive items later,” and “I attended social gatherings in business casual clothes because I couldn’t afford various kinds of clothes.”

In the comments, self-help jokes such as “The once poor teach the poor these days” and “The pork ribs that often appeared at dinner taste of the Great Recession” are also appearing repeatedly.

“Instead of buying cocktails at a bar (during the financial crisis), I had a home party and often drank jungle juice with a mix of cheap liquor and mixers,” said M.A. Lakewood, a fundraising expert. “At the time, I thought it was a trend, but it was a sign of recession.”

CNN said, “Young people in their early 20s in the United States are in an unprecedented situation where they may face a serious recession for the first time in their adult life. Income is falling, debt is increasing, and after the COVID-19 pandemic, they have been hit hard by extreme inflation. Millennials are sharing their wisdom to soothe their hearts.” Generation Z is also seen asking seniors for advice on what to do to overcome the recession. This is a change from the global financial crisis before the spread of SNS.

To make a habit of cutting spending, Imani Smith, a Dallas-based Tik Toker, said, “I decided to cut back on eating out and share my subscription password with friends. Instead of going to a hair salon, I buy press-on nails at Amazon. I also decided to cut down on small purchases such as expensive lip balms and candles,” asking her adult followers to rate her plans during the 2008 global financial crisis.

Meghan Way, an associate professor at Babeson College who studies the family economy and intergenerational economy, said, “In the late 2000s, if we had conversations with neighbors about recession know-how, it is now taking place in the digital space.”

Scott Sills, who works as a marketer, joked, “We are experts who have experienced the collapse of the floor firsthand,” adding, “Maybe it’s the first time millennials have been able to become experts on something.”

Some argue that the know-how at the time does not work because the current economic situation is different from that of the global financial crisis. Some content producers pointed out that the federal minimum wage has been frozen to 7.25 dollars since 2009, while the cost of living skyrocketed due to inflation and other factors. Another major difference is that bad debts that triggered the housing market crash do not exist now.

Kimberly Casamento, a digital media manager in New Jersey, introduces recipes based on a cheap meal cookbook published in 2009, and said, “The cost of ingredients for foods that were considered low-budget meals at the time has soared by about 100-150% now.” “It is difficult for anyone to live because it is expensive in every aspect of life. It’s a big win if you cut food costs by just $5,” he added.

Meanwhile, some predict that songs during the recession will become popular again. In fact, singers, songs, flash mobs and animations that were popular in the late 2000s are frequently appearing on social media these days, which are stimulating the nostalgia of millennials, CNBC reported.

JENNIFER KIM

US ASIA JOURNAL