China will provide 312 trillion won over 20 years to provide additional loans to developing countries on the verge of bankruptcy

International debt-laden diplomatic criticism also cuts swap lines as lenders face difficulties

Since 2000, China has sprayed $240 billion in developing countries. Although the decision was made for diplomatic influence on developing countries, it is pointed out that as these countries are on the verge of default, China seems to have fallen into a trap that increases the possibility of not being able to repay its debts.

The People’s Bank of China (PBOC) said it has provided at least $240 billion in funds to 22 developing countries, including Pakistan, Argentina and Nigeria, since 2000.

Using currency swaps to fund developing countries that have no repayment capacity

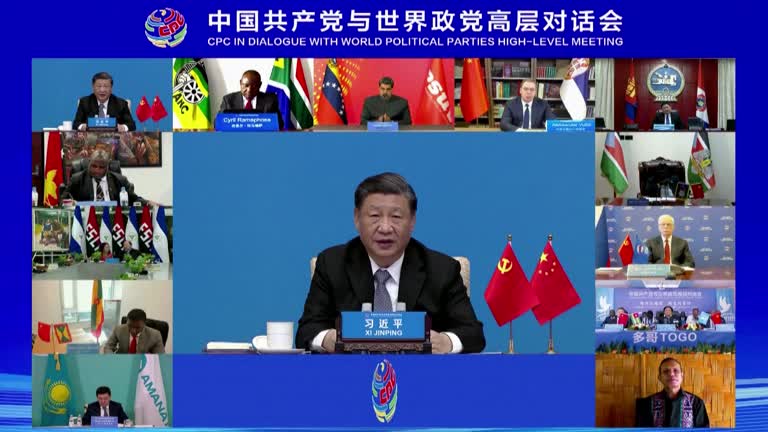

Of these, $185 billion, or 75% of the total funds, was intensively distributed between 2016 and 2021. This exceeds the $144 billion spent by the International Monetary Fund (IMF) during the same period. The support in the past five years has been attributed to the active promotion of the “One Belt, One Road (land and sea Silk Road)” initiative, an overseas infrastructure development project led by President Xi Jinping.

Much of the aid was provided through currency swaps. A currency swap is an inter-country contract in which one can leave one’s currency to the other country and borrow the other country’s currency or dollars in an emergency. It is usually an agreement signed to secure liquidity between countries, but China used it to fund infrastructure construction projects in developing countries. China has signed $580 billion worth of trade and currency swap negotiations with 40 countries over the past 20 years, during which 22 developing countries withdrew $170 billion in funds. The remaining $70 billion was raised through loans from the Chinese government.

Regarding China’s funding, he pointed out, “Most countries sign agreements to increase liquidity, but developing countries are using currency swaps to downgrade their credit ratings and raise insufficient government budgets.” In fact, China’s central bank is acting as an emergency fund channel like the IMF.There is also criticism in the international community that China has been saddled with debt to developing countries that have no repayment capacity. The huge amount of funding to developing countries is hidden in their intention to keep them in debt so that they cannot escape from China’s influence. According to the World Bank, China gave out loans at an annual interest rate of around 5% as of 2021. During the same period, the U.S. Federal Reserve’s currency swap interest rate averaged only 0%, and the IMF’s bailout rate was only 2% per year.Mahinda Rajapaksa in Colombo, the capital of Sri Lanka

However, as developing countries of COVID-19 faced a series of default crises, it is analyzed that the debt-laden diplomatic method acted as a negative factor for China. China has fallen into a vicious cycle of having to give loans again by crying to prevent countries that have lent money from going bankrupt.Pakistan, China’s largest creditor, is on the verge of national bankruptcy due to unfavorable factors such as COVID-19 and the Great Flood after suffering from massive external debt. In response, China put out the emergency fire in November last year by providing $4 billion in loans and $3.3 billion in loans through the Chinese government and the Chinese Commercial Bank, respectively. Pakistan narrowly escaped bankruptcy by agreeing with China to extend $1.3 billion in debt payments.

Moreover, China’s central bank is reportedly reducing its currency swap lines by country in recent years. Carmen Reinhardt, a former chief inonomist at the World Bank, argued that the PBOC’s move has much to do with developing countries’ debt problems to China. It is said that China has taken measures to reduce its currency swap line to indirectly rescue Chinese lenders who have been suffering from huge loans for one-on-one.The New York Times (NYT) said, “In September last year, China exempted about 0.3% of loans that African countries have not paid back for 20 years. In fact, he seems to have judged that it is unlikely to repay,” he said. “Loan has a much greater impact when demanding repayment than when it is given, so Chinese officials in developing countries are currently facing an uncomfortable situation to press for debt.”

Sophia Kim

US ASIA JOURNAL