“According to the commercial real estate analysis firm CoStar, the average daily price of a luxury hotel worldwide was $1,245 (about 1.82 million won) last year, up 8 percent from the previous year, which is an all-time high,” it said, citing the Financial Times, a British daily. Room occupancy also rose 2.3 percent, indicating that wealthy travelers did not feel much pressure despite the high inflation rate.

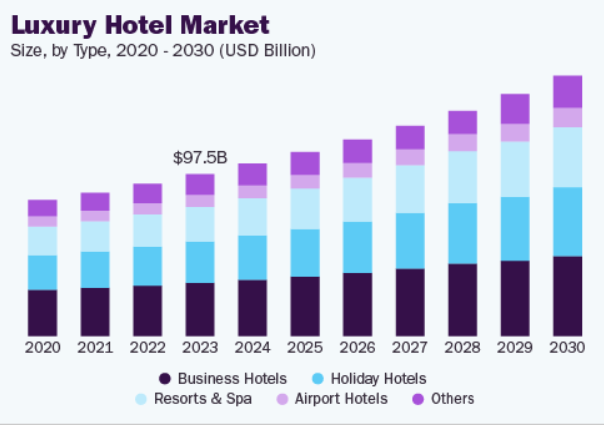

Sales per available room, which is mainly used to measure growth in the industry, rose 10.6% from the previous year, more than three times the growth rate of the hotel industry as a whole. Sales growth per available room of luxury hotels, including top-end hotels, was 5.8% and high-end hotels were 2.1%, while intermediate and entry-level hotels showed negative growth, indicating that more expensive hotels produced better sales.

Analysts say high-income travelers, whose available assets have increased, are showing a tendency to spare money for quality of life, with major stock markets on the rise all over the world and the cryptocurrency market being activated. Richard Clark, an analyst at investment firm Bernstein, explained to FT, “As the number of young travelers who have been called to assets such as cryptocurrency has increased, ultra-high-priced hotels have found confidence.”

The hotel industry is working hard to catch guests who are free from luxury consumption. The Marina Bay Sands Hotel in Las Vegas Sands even reduced the number of rooms by creating larger and more expensive suites, while the new hotel in the Bulgari Hotel and Resort decided to provide services that add to expensive well-being programs such as hyperbaric oxygen therapy. Rocoporte The Carlton Milan has a break room with low-frequency vibrating beds and a spa that provides therapy programs, and room prices range from 1,400 euros to 17,500 euros.

On the other hand, demand for other luxury markets such as designer products is weakening. According to a report released last year by consulting firm Bain & Company, the size of the personal luxury market, such as clothing and jewelry, decreased by about 2%. It was analyzed that the cause was the increase in tariffs by U.S. President Donald Trump and Chinese consumers’ “Guoqiao (prefering their own brand).” In particular, Gen Z consumers are re-evaluating the price and brand value that luxury brands have accumulated over a long period of time, the report noted.

SALLY LEE

US ASIA JOURNAL