Outside of China, TikTok is also trying to recreate Douyin’s success model, which is considered to be highly likely to succeed because TikTok has an absolute influence on the younger generation.

According to the Financial Times (FT), young Chinese people are purchasing luxury bags and clothing through live broadcasts just as they buy lipsticks or air fryers at Douyin.

While the live shopping broadcast host is joking while demonstrating the product, viewers immediately pay for luxury goods by pressing the screen once. This has already become a “basic shopping method” for millions of young Chinese consumers, Bloomberg said.

Douyin said sales in terms of transaction volume increased by 46 percent year-on-year in the year to July this year. It became the third largest online shopping platform in China last year.

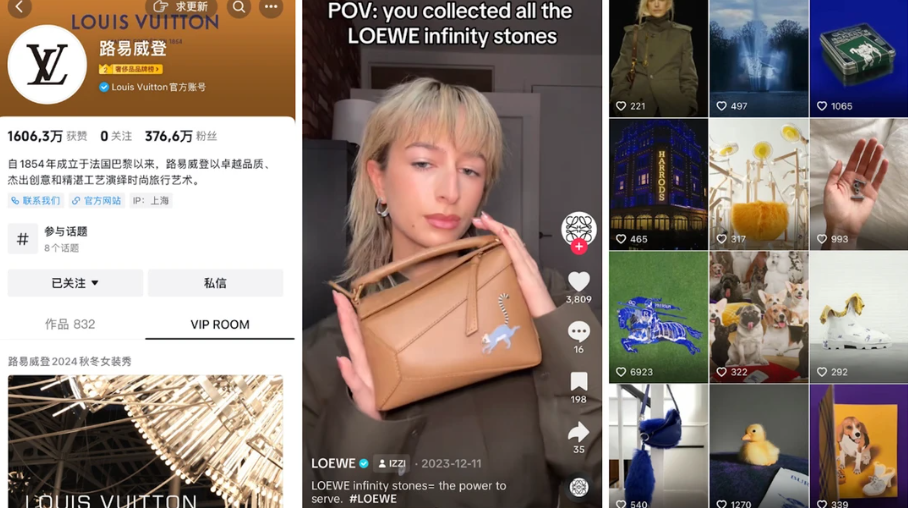

European luxury brands are also reacting fast. Versace opened its official flagship store by hosting a live broadcast on Douyin. Burberry even collaborated on virtual avatar outfits by participating in “Super Brand Day.”

In global markets such as the U.S., TikTok is expanding similar functions such as in-app payments, product search tabs, and shopping-related videos to recreate Douyin’s success model.

However, some say that it is not easy to target the luxury market because TikTok commerce outside of China is still recognized as a “virtual dollar shop.”

Nevertheless, some analysts say that TikTok is highly likely to succeed because it has a great influence on the younger generation. According to Imaketer, a U.S. market research firm, more than half of Generation Z are new to products on Instagram and TikTok. Boston Consulting Group predicts that Generation Z’s share of global luxury goods consumption will expand from the current 4 percent to 25 percent by 2030.

This trend suggests that luxury companies, which have been cautious about selling social media due to concerns about diluting brand value, may change their strategy. Turning a blind eye to TikTok may be a choice to miss the biggest customer base in the future.

SALLY LEE

US ASIA JOURNAL