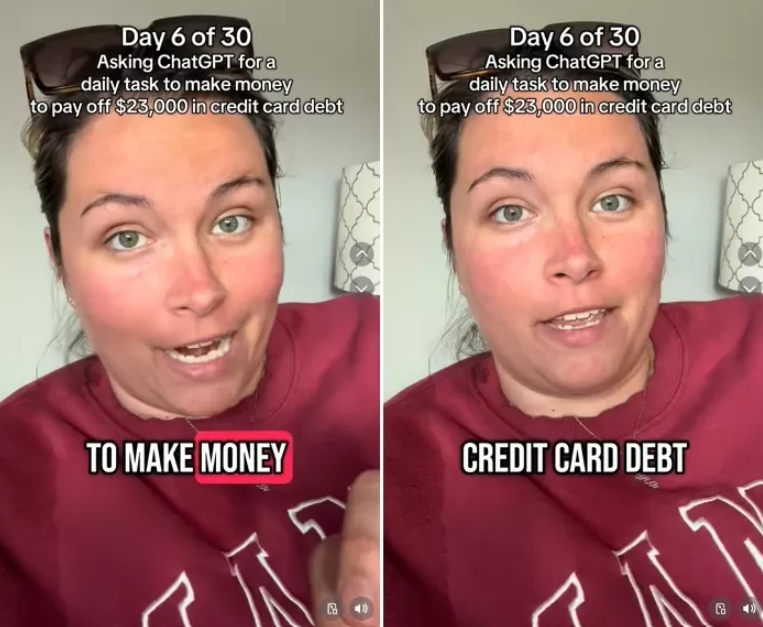

On the morning of the 11th, the U.S. ABC introduced the process of Jennifer Allen, a real estate agent living in Florida, using artificial intelligence to resolve debts worth about 37 million won. She revealed her journey on TikTok under the title of the “30-day ChatGPT Challenge.”

According to the broadcast, Allen did not skip a day and asked artificial intelligence ChatGPT, “What can I do today to make money?” As a result of repeating this simple question, he earned more than $11,000 in a month, of which $12,000 was spent on actual credit card payments.

The AI-proposed method was completely different from conventional financial counseling. “Chat GPT wrote down my total debt on a watermelon and asked me to take a picture and put it up for auction, calling it ‘debt art,'” Allen said. “I actually sold the picture for 51 dollars.” The video received a lot of attention with more than 2 million views on TikTok.

In addition, ChatGPT consistently presented strategies that are closely related to real life, such as canceling subscription services that are not being used, selling used items, and organizing a diet using stored ingredients. It not only generates revenue but also reduces spending.

Allen also made some unexpected discoveries during the challenge. He found 100.8 dollars on Venmo, a mobile remittance platform. “He said, ‘We don’t even have a stock account,’ but he had 10,200 dollars left in the account that he had forgotten.”

The month-long experiment brought about substantial changes in Allen’s economic situation, and his message was simple: “The process of facing up to debt every day and recording it and speaking to yourself was paramount. I am not ashamed anymore.”

The broadcaster also shared experts’ opinions on the matter. Ted Rothman, chief analyst at financial analyst Bankrate, said that savings are decreasing and household debt is on the rise. “It is important to avoid unnecessary large-scale spending and make the most of existing assets.” “AI can be a useful tool, but when making financial decisions, you need to make your own judgment,” he stressed.

JENNIFER KIM

US ASIA JOURNAL